You Either Get It Or You Don’t

The View From a South African Finance Professional

by Imran Lorgat | May 21st, 2020 | vol.2

In October 2018 I presented on Bitcoin at the annual convention of the Actuarial Society of South Africa.

In the South African financial industry, there are few platforms bigger than this. The title of my talk was Bitcoin Decrypted: What Does It Mean for Financial Services.

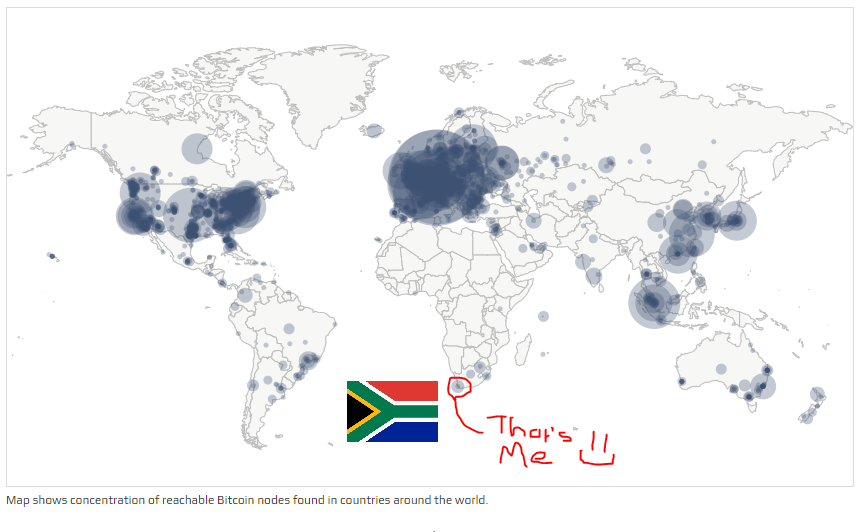

The premise of my talk was simple. I was there to tell the top people in the financial sector that the game was about to irreversibly change. Over the next hour I took them through transactions on the Bitcoin mainnet and the Lightning Network, and then explained to them how you can pay anyone, anywhere in the world. And that you can do it at any time, with no banks, no KYC, no one centrally in charge, and no one can stop you.

“Bitcoin is going to do banking what e-mail did to the post office”, I told them at the end, after pointing out that more than a billion dollars’ worth of Bitcoin was already being transacted daily on the Bitcoin network.

The optimist in me hoped I’d dropped a bombshell. The realist in me knew better. Over the previous year I’d travelled around South Africa and given variations of this talk at conferences of all kinds, and I’d written about Bitcoin in a handful of financial publications. By then I’d learned that you could separate the audience into three parts.

First, there were those who thought Bitcoin was a bubble and a scam before the talk, the ones with their arms folded and scowls on their faces, not about to get their opinion changed.

Second, there were those who had only a lukewarm interest, not enough to do any real research and likely to forget my talk in a couple of days.

And lastly, there were those who understood, whose eyes lit up and came to thank me afterwards. These people were always Bitcoiners before the talk began.

Despite the hundreds of hours I put into researching and designing my pitch, practicing it at venues around the country, I’m not sure if I convinced anyone new. Oh the feedback was good; “Interesting talk,” they told me, “Lots to think about”.

I might have sparked the interest of some people, but I don’t think I managed to switch on the light bulb in anyone’s head. That same light bulb that had switched on in me, years earlier, when I first truly got Bitcoin and it felt like the floor fell out from under me.

In the year and a half since the ASSA convention, I’ve spent hours talking with friends and colleagues about Bitcoin. Going deep into the technical and social intricacies, talking late into the night about hash functions, and digital scarcity, and whether blockchain is a meaningful concept outside of Bitcoin (it mostly isn’t). But it was always with people who came to me for these discussions, never with anyone I persuaded.

And it’s after years of being in this space and trying to share knowledge, I’ve understood something basic about Bitcoin: you either get it or you don’t.

Going back to my own light bulb moment years before, it came during a time of deep research. I’d read the Bitcoin whitepaper, listened to hours of Andreas Antonopolous’ talks, and wracked my brain trying to understand the technical intricacies.

I remember the moment. I was in my kitchen, reading Digital Gold by Nathaniel Popper, about Bitcoin’s repeated catastrophes: Satoshi leaving, MtGox’s collapse, Silk Road shutting down, overflow bugs, negative press, price crashes, banks closing Bitcoin companies’ accounts, hundreds of “experts” declaring Bitcoin dead.

I’m sure Popper intended this to be sensational drama. I took away something different. “Bitcoin went through all of this,” I told my wife, “Any one of these disasters would have destroyed a company or project, and instead of failing and fading into obscurity, each time Bitcoin became more valuable than it was before”.

The word ‘antifragile’ went through my head, a system that grows from crisis to crisis, a word I’d understood by reading Nassim Taleb cover to cover and spending years in the business of managing financial risk.

It was then I understood that Bitcoin could not be easily killed, and that attempts to kill it would only make it stronger. And why would anyone try to kill it? Because it’s money, it can’t be debased, and no government or bank controls it. And if it’s not immediately obvious to you why many powerful institutions will inherently despise Bitcoin to its core, then I don’t think I can explain it. You either get it or you don’t. And I think you’ll get it if you need to get it.

So why did I need to get it? At the time of my light bulb moment I’d been working for some years as an actuary for insurance companies in South Africa. This was a profession I’d qualified for after twelve years of school, and then four hard years of college studying day and night, and then another few years of exams after that.

It was a grueling road, and it was supposed to be a ticket to the good life. Only it wasn’t. I won’t lie, I was better off than most people my age, but let me put it this way: neither of my parents had degrees, and when my father was in his thirties he could afford a big house in the suburbs, despite my mother being a stay-at-home mum, and them having two kids going to a top school. He could even afford a BMW and overseas vacations. And this was shortly after the end of the Apartheid years where non-whites in South Africa had been systematically underpaid and denied quality education for generations. My parents saved up all those years to get their two sons into college so they wouldn’t have to struggle like they did. And yet as I approached my thirties, a qualified financial professional, I still wasn’t in the same league as my dad. My wife and I both have degrees, we both worked, had no kids, and yet we didn’t have a fraction of the lifestyle my dad could provide growing up.

I don’t want to sound ungrateful, and our situation has markedly improved since. And, of course, I don’t have to experience the racism my parents and grandparents experienced daily.

It’s simply that the world economy doesn’t offer me what it offered my parents. And in South Africa, even more so.

You need only to take one look at the Dollar-Rand chart to understand that South Africans have been through hell in the last decade. When I was in school it used to be around R6 to a Dollar and as I write these words it’s over R18.

What that means is that everything that’s imported costs around three times as much as before, before accounting for inflation. Books, phones, computers, clothing, TVs, shoes, appliances, petrol, cars, even many food brands are purchased from overseas.

And it’s not like wages kept up. Rather it’s been the opposite. I used to find it bizarre how Americans would find Obama’s 8% unemployment unacceptable, when South Africa had 25% unemployment over the same period. Numbers aside, what that meant for young people, was that even getting a prestigious degree from a top university didn’t guarantee you a job. My wife spent the first few months of her career unemployed, despite having an Honours in commerce with top marks, and then had to take a job outside of her field and below her pay grade.

Like I said, our situation is a lot better these days. But it was a hard grind to get here, and made that much harder by how the economy worked against us. It felt like every time one of us got an increase or a better job, that increase would be eroded. Perhaps because the South African Rand would crash over some political scandal, or because government bonds got downgraded to junk status, or because electricity prices went up 25% because corrupt utilities companies were bankrupt (again).

I have a distinct memory of one of my bosses retiring, after saving for fifty years, to join his sons in the USA. A few months before he retired, the South African president fired the finance minister for political reasons, and the Rand crashed overnight. In just a few days, his retirement plan of fifty years had to be called off. There were greater forces at play than any of us had a say about, and it felt like we were stuck on board a sinking ship.

I think it’s the sum of these circumstances that made me get Bitcoin soon after I discovered it. It fulfilled a need.

After years of watching my hard work get eroded by inflation, falling exchange rates and poor stock market performance, here was an asset that couldn’t be debased because politicians stole the tax money to pay for some guy’s wedding (no really, this is real. Google “Gupta Wedding Scandal”. Politicians laundered over R30m, around $3m in 2013, to pay for a wedding. Despite my tax money funding the event, I was not invited).

Here was an asset free from big business, geopolitics and power-hungry people wanting to co-opt it for their own benefit. In fact, over the years Bitcoin seems to have ejected every person who tried to do just that.

It took me only a few months to go from that light bulb moment, to understanding that Bitcoin is the technological innovation of our decade, if not our lifetime.

And despite the price going all the way from $3k to $20k and then back to $3k again, it didn’t shake my confidence. I’d read the history. I knew Bitcoin had crashed worse before and had come back stronger. Bitcoin, I knew, has a future. My own country’s currency? It’s difficult to say.

So going back to that room where I gave my talk at the 2018 Actuarial Convention, a part of me wonders if I failed to convince those people about Bitcoin because they don’t need it. For many of those top finance people, the economy has worked for them. They’re at the tail end of prosperous careers, and they’ll go on to retire on healthy pensions and medical aids earned in better times, and perhaps even partially paid for at younger peoples’ expense. They’ve spent years amassing fortunes, so why should they, in their 50s and 60s, take a risk on this new “Bitcorn” thing, which can fail? But for those of us whose 50s and 60s are looking only more precarious as time goes on, there’s a different story to be told.

I don’t think Bitcoin solves every problem. And I don’t think it’s lived up to every promise it’s early visionaries made. In my honest view, I suspect it’ll take another twenty or thirty years before Bitcoin can successfully do everything we want it to do at scale. And at this stage, investing in it is a huge risk; likely the next ten years are going to be a lot bumpier than the first.

But I’ll tell you what Bitcoin has delivered: a Plan B.

An exit strategy. An alternative. For the first time in my lifetime, I can look at this messed up global economy, with it’s climbing youth unemployment and it’s failing third-world currencies, with the mountains of debt that future generations are expected to repay, and I can say: “Nah, I’ll do something different”.

For people in the USA and Europe, Bitcoin might be about citadels and Lambos. “Number go up”. For me at least, it’s about the inverse: “Number not go down”.

Imran Lorgat is an actuary working for a global reinsurer. He’s worked in South Africa, Europe, and the Middle East. Being a hodler, Imran is in the strange position of being both a part of the legacy financial system and the new one being built. Aside from his job, Imran writes about Bitcoin, risk, and finance in various financial publications (and one academic journal) and gives talks on Bitcoin at conferences.